green card exit tax amount

Likewise green card holders can avail themselves of the full annual gift tax exclusion from US. US Exit Tax IRS Requirements.

If Your Divorce Wasn T Already Taxing Enough In 2022 Wedding Money Green Cards Marriage

The amount is adjusted by inflation 2018s figure is 165000.

. The individuals annual net income tax liability for the prior five years was greater than 145000 2010 amount or. Green Card Holders and the Exit Tax. The IRS considers a Green Card holder who stayed in the US for at least 8 years out of the last 15 years a long-term resident.

Exit Tax or apply for a bond which can be very expensive. If you work from a company that withholds income taxes from your check then you should file a tax return. This means that in the perspective of exit tax you are unable to place a 401K towards the 725000 exit tax free amount.

Legal Permanent Residents is complex. Beware Exit Tax USA. For US Green Card holders who have been in the US for 8 years of the last 15 or more anything above about 2 million will likely take some tax planning and structuring work to reduce the exit tax.

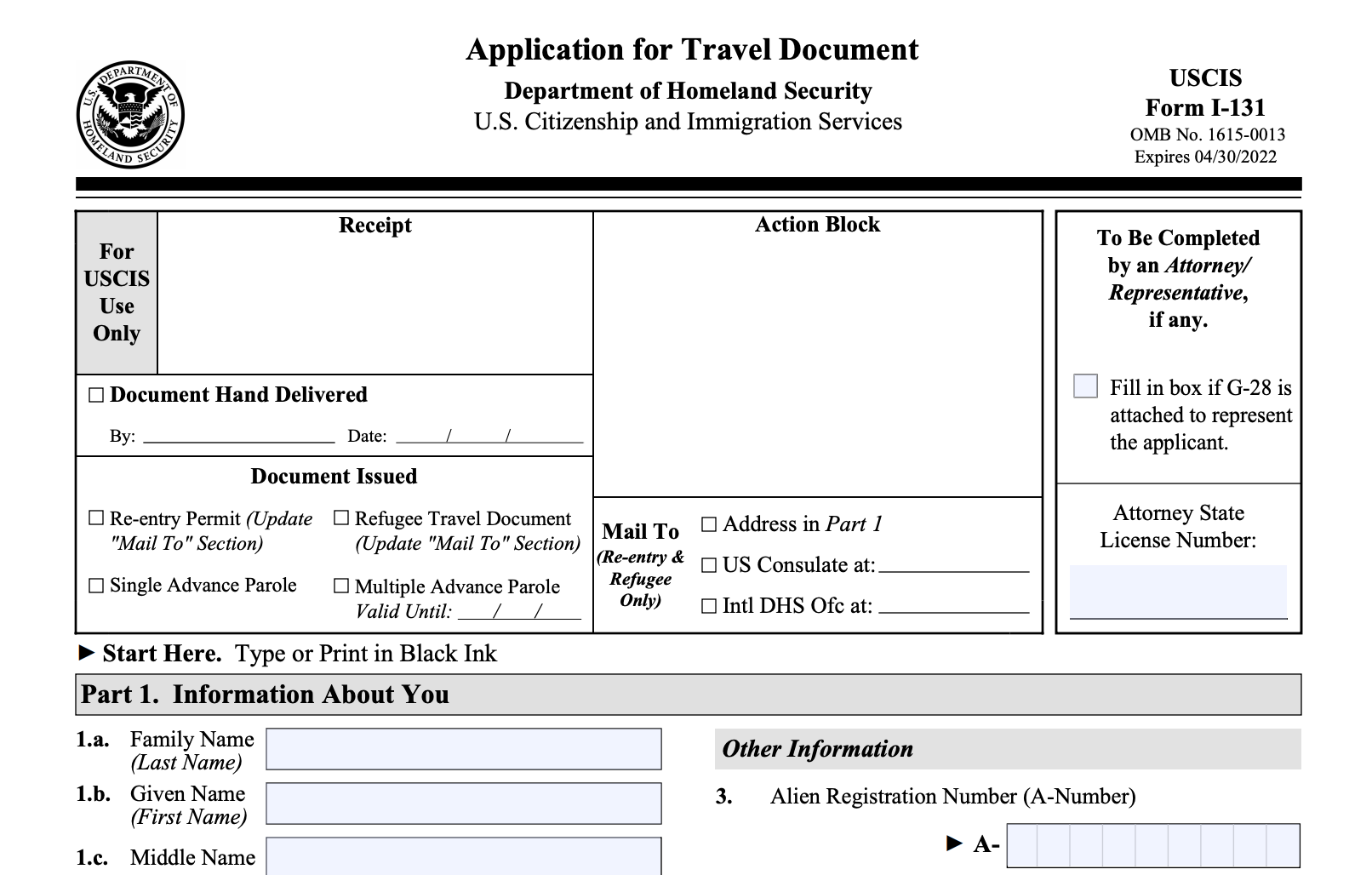

Another important trigger for taxation upon the termination of a Green Card is the certification test. The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. Green Card Exit Tax 8 Years Tax Implications at Surrender.

The IRS Green Card Exit Tax 8 Years rules involving US. Expatriation for Legal Permanent Residents Green Card Holders may result in IRS Exit Tax. As you can see the Green Card tax implications are complex.

Permanent residents can give up their Green Cards too but there may be a tax cost in the form of a US. The expatriation tax rule only applies to US. Status they are subject to the expatriation and exit tax rulesBut the rules are not limited to.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. If you are neither of the two you dont have to worry about the exit tax. But the tax will still be imposed if they have not met the five year tax compliance test.

Green card exit tax amount. A long-term resident is defined as a lawful permanent resident in at least 8 of the 15 years period ending with the expatriation year. Permanent residents and green card holders are also required to pay taxes.

Tax liability another way to trigger the tax is to have a high net income during the five years leading up to losing your status. US tax planning BEFORE getting a Green Card is essential. Green card holders are also affected by the exit tax rules.

Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. The exit tax planning rules in the united states are complex. Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay.

If you are neither of the two you dont have to worry about the exit tax. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable years ending with the taxable year during which the. For example if you made a profit of 750000 on your assets exit tax would only apply to 25000 of that amount.

Fraud relating to underpayment can be punishable by up to 75 of the unpaid tax in addition to the correctly-determined owed amount. The exit tax rules apply to individuals who are considered covered expatriates For an individual who gives up his or her citizenship or green card to qualify as a covered expatriate one of the following must also apply. Green card taxes are required for green card holders.

Giving Up Your Green Card or US Citizenship Can Be Costly. For example if you got a green card on 12312011 and. In this first of our two-part series we explain some of the principal terms of the exit tax.

In 2017 that threshold was 162000 per year. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents. Estate tax under the newly enacted Tax Cuts and Jobs Act indexed for inflation this amount is 112 million per individual.

In 2015 the japanese diet approved a bill imposing an exit tax on wealthy individuals. Depending on what the total gain is if the gain exceeds the exemption amount currently 725000 the expatriate may have to pay a US. Citizen renounces citizenship and relinquishes their US.

Note that the amount refers to net income any deductions that reduce your. As such he or she might have to pay exit tax. The average annual net income that you are taxed on for the five years before you expatriate is more than a set amount.

The general proposition is that when a US. Exit Tax Expatriation Planning. The most important aspect of determining a potential exit tax if the person is a covered expatriate.

Currently net capital gains can be taxed as high as 238 including the net. Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status. Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation 162000 for 2017 165000 for 2018 168000 for 2019 and 171000 for 2020.

Citizens or long-term residents. US Citizens are not the only people required to pay taxes to the US. The Exit Tax Planning rules in the United States are complex.

Paying exit tax ensures your taxes are settled when you. Green Card Exit Tax 8 Years. The expatriation tax consists of two components.

Gift tax indexed for inflation this amount is 15000 per donee and the full estate tax exemption from US. For Green Card holders the question is how long they have had it. Here are 5 Things You Should Know Before Filing Form 8854.

A green card holder must have been a lawful permanent resident in eight of the 15 years ending with the year of expatriationin other words the green card holder is a long-term resident a defined term in the IRC. However a retirement fund such as a 401K is a free tax income as you havent paid any tax on this. Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit tax.

The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident. But if you are a Green Card holder and have only had it for two years you may not be considered a long-term resident and then wouldnt have to worry about.

The Benefits Of A Green Card Boundless

Mailler For New Package Of Singapore Airlines Singapore Airlines Langkawi Airlines

Exit Tax Us After Renouncing Citizenship Americans Overseas

What You Need To Know About Re Entry Permits For Green Card Holders

What You Need To Know About Re Entry Permits For Green Card Holders

Green Card Number Explained In Simple Terms Citizenpath

Percent Discount And Sales Tax Assignment Project 7th Grade Math Math Curriculum Life Skills Classroom

Exit Sign Exit Sign Emergency Exit Signs Exit Strategy

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Real World Math Project In 2020 Math Projects High School Students Math

Exit Realty Corp Presentation Folders Presentation Folder Presentation Maps And Directions

Renounce U S Here S How Irs Computes Exit Tax

Here Are The Best Places To Retire Abroad Best Places To Retire Retire Abroad Retirement

Percents Taxes Tips Discounts Word Problems Percent Word Problems Word Problems Word Problem Worksheets

Expat Tax 2020 Formal Emigration Is Not The Answer Emigration Expat Tax

15 Totally Genius Money Saving Hacks That Ll Blow Your Mind Of Life And Lisa Money Saving Tips Budgeting Finances How To Plan